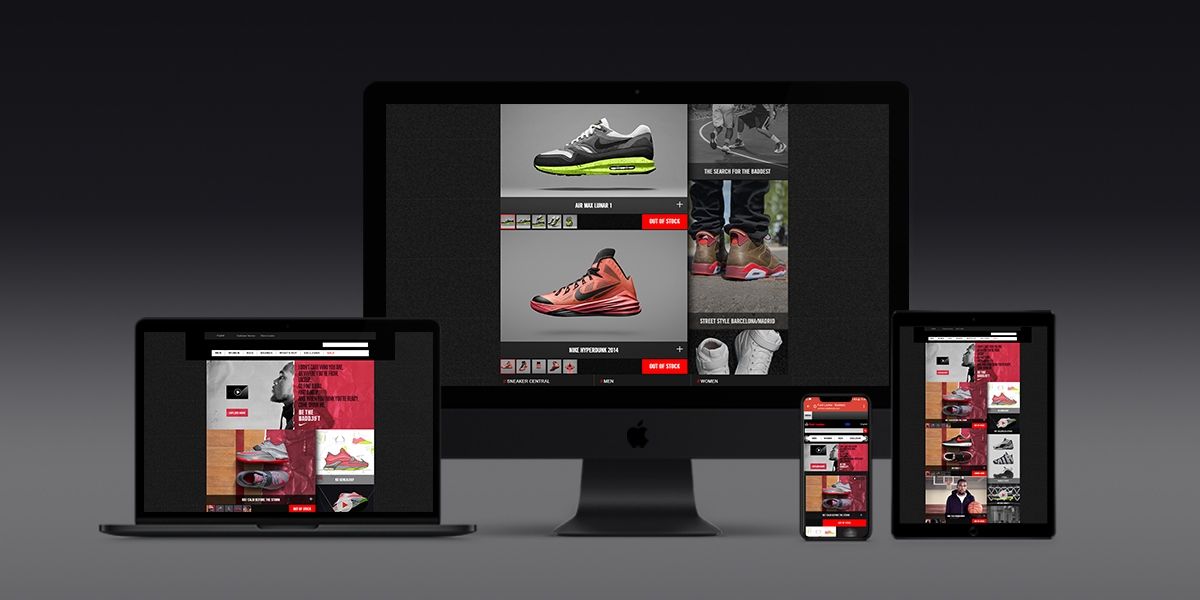

There might not be a relationship more historically intertwined between a retailer and a brand like that one of Nike and Footlocker. Foot Locker is a multi-channel specialty retailer of athletic footwear and apparel, operating mall-based stores under various formats. Footlocker carries around 68% of total stock in Nike merchandise and around 78% of that is Footwear. It’s importance in growing digital business for the running category was undisputed.

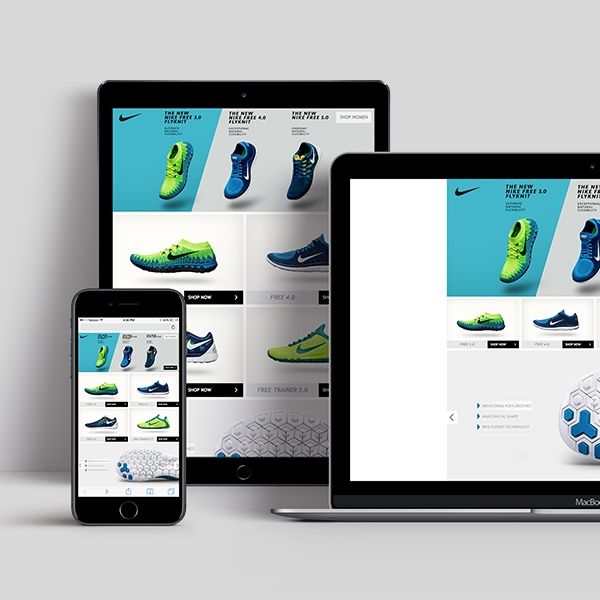

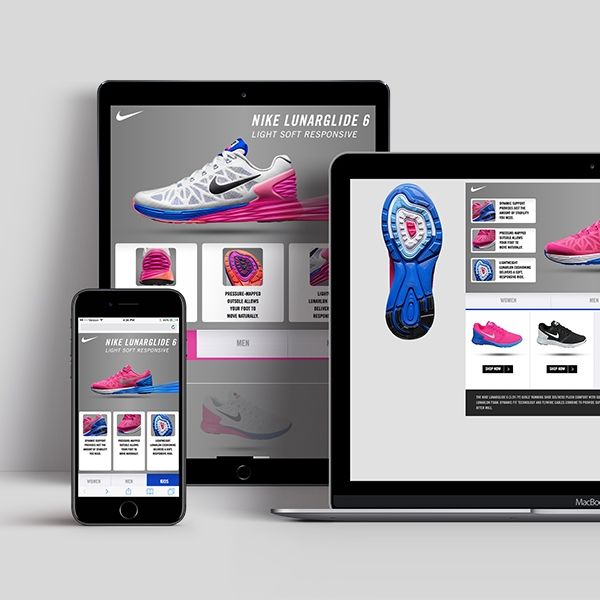

According to company’s Annual Report, In 2017 around 68% of Footlocker purchaes came from Nike. In 2016 Footware sales accounted for 82% of the revenue, while Apparel accounted for 18%. From 2013 until 2017 share of e-commerce sales to total revenue grew from around 11% to 14,4%. And growth in e-commerce which peaked in 2014 to 21% from 16% year before to slow down in later years has been the major if not only growth driver with very sluggish pyhsical retail stores growth performance that was even negative –1,1% in 2016. As one of the strategic partners in wholesale, the evolution of Nike brand on Footlocker’s e-commerce & digital properties was one of the key brand strategy goals

To view the full project please

REQUEST ACCESS

(EMEA) 14 markets

(EMEA) 14 markets (EMEA) 47 markets

(EMEA) 47 markets (EMEA) 17 markets

(EMEA) 17 markets (WHQ)

(WHQ) Europe (10 markets)

Europe (10 markets) WHQ

WHQ